44% of TikTok’s all-time downloads were in 2019, but app hasn’t figured out monetization

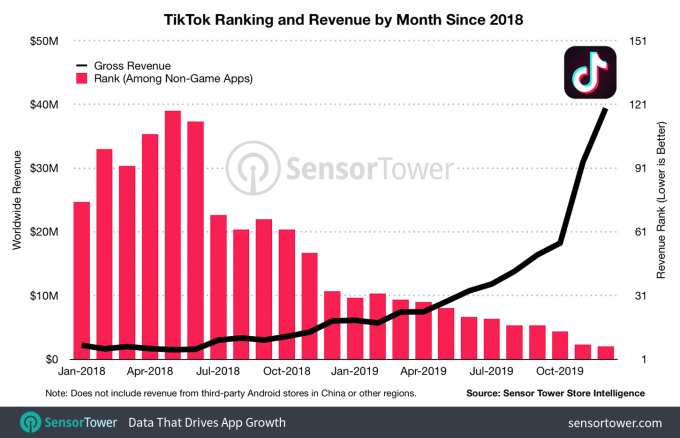

Despite the U.S. government’s concerns over TikTok which most recently led to the U.S. Navy banning service members’ use of the app, TikTok had a stellar 2019 in terms of both downloads and revenue. According to new data from Sensor Tower, 44% of TikTok’s total 1.65 billion downloads to date, or 738+ million installs, took place in 2019 alone. And though TikTok is still just experimenting with different means of monetization, the app had its best year in terms of revenue, grossing $176.9 million in 2019 — or 71% of its all-time revenue of $247.6 million.

Apptopia had previously reported TikTok was generating $50 million per quarter.

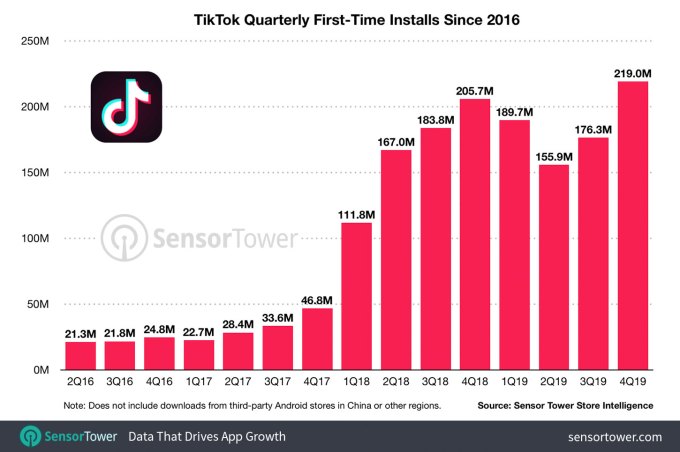

The number of TikTok downloads in 2019 is up 13% from the 655 million installs the app saw in 2018, with the holiday quarter (Q4 2019) being TikTok’s best ever with 219 million downloads, up 6% from TikTok’s previous best quarter, Q4 2018. TikTok was also the second-most downloaded (non-game) app worldwide across the Apple App Store and Google Play in 2019, according to Sensor Tower data.

However, App Annie’s recent “State of Mobile” report put it in fourth place, behind Messenger, Facebook, and WhatsApp — not just behind WhatsApp, as Sensor Tower does.

Regardless, the increase in TikTok downloads in 2019 is largely tied to the app’s traction in India. Though the app was briefly banned in the country earlier in the year, that market still accounted for 44% (or 323M) of 2019’s total downloads. That’s a 27% increase from 2018.

TikTok’s home country, China, is TikTok’s biggest revenue driver, with iOS consumer spend of $122.9 million, or 69% of the total and more than triple what U.S. users spent in the app ($36M). The U.K. was the third-largest contributor in terms of revenue, with users spending $4.2 million in 2019.

These numbers, however, are minuscule in comparison with the billions upon billions earned by Facebook on an annual basis, or even the low-digit billions earned by smaller social apps like Twitter. To be fair, TikTok remains in an experimental phase with regards to revenue. In 2019, it ran a variety of ad formats including brand takeovers, in-feed native video, hashtag challenges, and lens filters. It even dabbled in social commerce.

Meanwhile, only a handful of creators have been able to earn money in live streams through tipping — another area that deserves to see expansion in the months ahead, if TikTok aims to take on YouTube as a home for creator talent.

When it comes to monetization, TikTok is challenged because it doesn’t have as much personal information about its users, compared with a network like Facebook and its rich user profile data. That means advertisers can’t target ads based on user interests and demographics in the same way. Because of this, brands will sometimes forgo working with TikTok itself to deal directly with its influencer stars, instead.

What TikTok lacks in revenue, it makes up for in user engagement. According to App Annie, time spent in the app was up 210% year-over-year in 2019, to reach a total 68 billion hours. TikTok clearly has users’ attention, but now it will need to figure out how to capitalize on those eyeballs and actually make money.

Reached for comment, TikTok confirmed it doesn’t share its own stats on installs or revenue, so third-party estimates are the only way to track the app’s growth for now.

No comments

Note: Only a member of this blog may post a comment.