Zinier raises $90M to automate field service management

Zinier, a startup that is bringing automation to the field service management realm, announced today that it has raised $90 million in fresh funding as it looks to tackle new categories and court more clients.

The San Francisco-based startup said its $90 million Series C financing round was led by ICONIQ Capital and saw participation from Tiger Global Management, and existing investors Accel, Founders Fund, Qualcomm Ventures, Nokia-backed NGP Capital, and France-based Newfund Capital.

The new financing round pushed the five year-old startup’s total raise to $120 million, and valued it above $500 million, one of its investors told TechCrunch. Zinier co-founder and chief executive Arka Dhar declined to comment on the valuation.

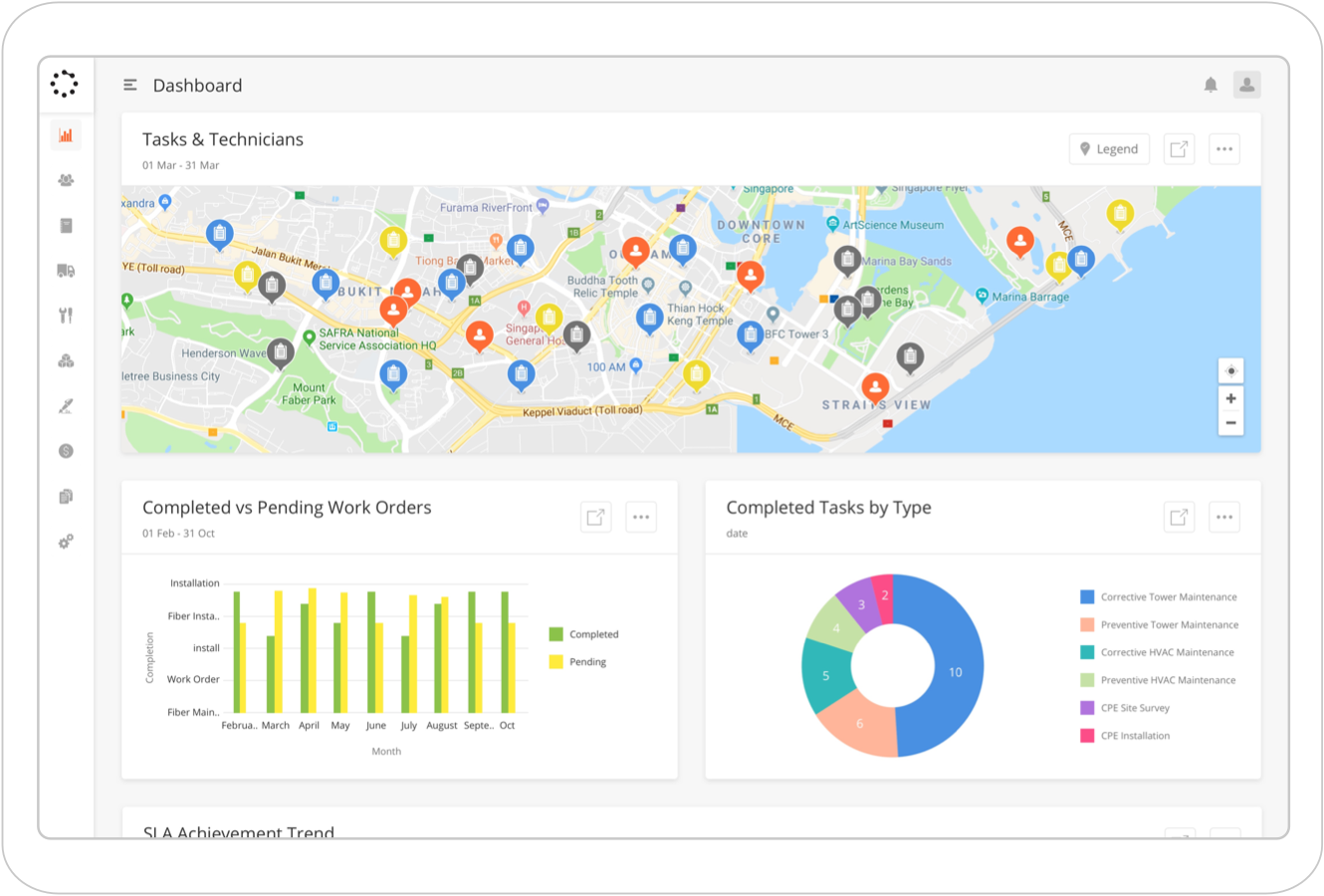

Zinier is helping the electricity and telecom industries automate their field services, a job that has typically innovated slowly and relied on legacy systems and manual processes, Dhar told TechCrunch in an interview.

“Field service means everything that happens from work of origination, their scheduling and dispatching, matching the right person with the right task at the right location, and at the end, verifying the task. It’s a complex, manual and disparate system. It typically sees 20% of our client’s expenses. We are optimizing these processes with AI to help these clients become more efficient and save money,” said Dhar.

Dhar declined to reveal all the major Zinier’s clients, but said some of the biggest players in the electricity and telecoms businesses work with the startup. 40% of the startup’s clients today are based in the U.S., 40% is in Latin America, and the rest is in Asia Pacific. The startup said it works with Black & Veatch and Car-Sa, and maintains strategic partnerships with system integrators such as Capgemini and Tata Consultancy Services.

Until two years ago, Zinier focused on the telecom industry, but has since expanded to serve energy and utility spaces. The fresh fund would help the startup double down its efforts in non-telecom industries, Dhar said.

A number of players are working on the field service management space. Major giants such as Salesforce and Microsoft own stakes in firms that operate in this industry and also offer their own products. ServiceMax was earlier acquired by GE Digital for $915 million. Without calling names, Dhar cautioned that some of its competitors are merely digitizing the pen and paper logs, and are not really optimizing the process.

“It is critical for companies to optimize this costly and complex part of their business, and Zinier has the platform-based technology and team to take on this global, multi-industry market. We are excited to partner with Zinier and support them in their mission of changing the paradigm on field service work on a global scale,” said Will Griffith, Partner at ICONIQ Capital.

No comments

Note: Only a member of this blog may post a comment.